5736

|

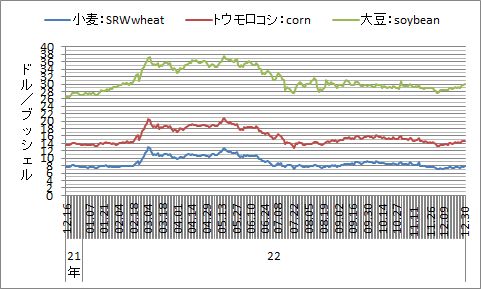

シカゴ商品取引所小麦・トウモロコシ・大豆先物相場(期近・セツルメント)の推移 史上最高:小麦=9.24/bushel(08.6.26) トウモロコシ=7.7325/bushel(08.6.1) 大豆=16.58/bushel(08.7.4) コメント/関連ニュース:最新

(22年1月8日) 大豆滓需要と南米の天候が大豆価格を押し上げる(Soybeans rally, following soymeal gainsReuters,22.1.7) (21年12月22日)

Soy hits highest price since August on South America crop worries,Reuters,21.12.21 CHICAGO, Dec 21 (Reuters) - Unfavorable dryness in crop-growing areas of South America on Tuesday pushed Chicago Board of Trade

soybean futures to their highest price since August and helped lift corn futures, analysts said. (21年12月18日) [高騰ショック]配合飼料2900円上げ 全農1〜3月最高値を更新 日本農業新聞 21.12.18 (21年11月30日) Wheat drops as dollar edges higher; Australia

forecasts record crop,Reuters,21.11.30 CHICAGO, Nov 29 (Reuters) - U.S. wheat futures retreated on Monday on a firmer dollar and as a record harvest outlook from major exporter Australia eased recent concerns about rain-damaged crops.Corn and soybeans followed wheat lower, pressured by technical selling and profit-taking and by good weekend rains in Argentina and parts of Brazil. (21年11月23日) 小麦、9年来の高騰 Wheat prices in Russia rose for a fifth straight week last week on strong demand. Shipments from the world's largest exporter are down 34% this season due

to a smaller crop and rising export taxes. Heavy rains, meanwhile stalled harvesting in Australia and threatened crop quality, while flooding in western Canada has disrupted exports

when global demand for wheat has risen. (21年11月18日) U.S. WHEAT FUTURES RISE AS EXPORT MARKET HEATS UP(Reuters)

Successful Farming,21..11.17 (21年11月11日) 小麦がグローバルなタイトなサプライと輸出需要増加で12年12月以来の8ドル台に高騰。ロシアは国内価格高騰に際しての輸出税の計算方法の変更や輸出割当を検討している。 GRAINS-Wheat futures rally as global stocks tighten; corn, soy also strong,Reuters,21.11.10 Crop Production USDA 21.11.10 関連:ニップン、家庭用小麦粉を1.5〜9%値上げ 日本経済新聞 21.11.10 (21年10月29日) GRAINS-Wheat futures hit multiyear

highs; corn firm, soy weak,,Nasdaq,21.10.28 CHICAGO, Oct 28 (Reuters) - U.S. wheat futures rallied to multiyear highs on Thursday with concerns about tight global supplies and strong export

demand fueling the gains. MGEX spring wheat hit its highest level since June 2011 on expectations that overseas buyers will soon begin looking to the United States to fill

their orders for high-protein wheat. (21年10月2日) GRAINS-Wheat hits near 3-week high on USDA stock forecast,Reuters,21.10.1 CANBERRA, Oct 1 (Reuters) - U.S. wheat futures edged up to near a three-week high on Friday, after the U.S. Department of Agriculture (USDA) pegged stocks at their lowest level

since 2007. (21年9月9日) 農水省が輸入小麦政府売渡価格を引き上げた途端に、シカゴ小麦は7月以来初めてブッシェル6ドル台に落ち込んだ。 カナダのリポートがカナダの小麦供給が予想外に多いと報告したためという。 なお、トウモロコシは今年1月初め以来のブッシェル4ドル台、]大豆も昨年12月末以来のブッシェル12ドル台転落だ。 GRAINS-U.S. corn, soybean, wheat futures fall ahead of

USDA report,Nasdaq,21.9.9

(21年9月8日)

輸入小麦の政府売渡価格の改定について 農林水産省 21.9.8

→

(21年9月1日)

ハリケーン・Idaの影響で輸出が滞る恐れ GRAINS-Corn, soybeans sag on U.S. export

worries after Ida; wheat follows,Nasdaq,21.9.1 U.S. corn futures fell about 2% on Wednesday, with the benchmark December contract hitting a seven-week low as worries about shipping delays from the U.S. Gulf Coast

triggered a round of long liquidation, analysts said.

(21年7月20日)

21年7月14日から15日にかけトウモロコシが急落しているが、これは限月が変わった(JLY22→SEP21、小麦も同じ)ためである。

(21年6月18日) Top agricultural traders predict a ‘mini supercycle’,FT.com,21.6.18 Markets for corn, soyabeans and wheat expected to remain strong over next few years Agricultural commodities are at the start of a “mini-supercycle” with prices expected to be boosted for several years by demand from China and for biofuels, according to some of the world’s top traders.

(21年5月21日)

As

corn prices surge, China substitutes wheat, rice as feed ,Hindu Business,21.5.20

(21年5月3日)

トウモロコシが小麦に追いつく。

(21年4月23日)

GRAINS-Corn highest

since 2013, soy tops $15 and wheat over $7 on supply fears,Nasdaq,21.4.22

(21年4月22日)

GRAINS-Corn at highest since 2013 on U.S. weather, soybeans

up 1.3%,Reuters,21.4.22 * Corn extends gains as cold weather hurts newly planted U.S. crop

Corn Is Surging as U.S. Sees China

Imports at All-Time High,Bloomberg,2,.4.22 (21年4月15日) GRAINS-U.S. cold snap fears fuel rally in wheat, corn, soy

futures,Succesful Farming,21,4,14 CHICAGO, April 14 (Reuters) - U.S. wheat, corn and soybean futures rallied on Wednesday, supported by concerns that a cold snap in the U.S. Midwest and Plains could hamper crop

development, traders said. Chicago Board of Trade corn gained 2.8% to hit its highest since June 2013. Wheat futures posted the biggest increases, with CBOT soft red winter wheat futures jumping 3.2%, while K.C. hard red winter wheat rising 3.4%. "Cold surge next week poses spotty wheat damage risk in southern one-third of the U.S. Plains; possible burn back to emerged Midwest corn," Commodity Weather Group said in a

note to clients. The weather also could cause some growers to delay their planting of corn and soybeans as crops seeded in the cold temperature could struggle to emerge from soils. (21年3月20日) 配合飼料5500円上げ 原料高騰続く 全農4〜6月 日本農業新聞 21.3.20 (21年2月12日) China’s record purchase of corn a ‘wartershed moment’,Financial Times,21.2.12,p.10 China’s record corn purchases have traders wondering

if bump can last,FT.com,21.2.12 Prices surge to near eight-year high as

demand from Beijing fuels grain market rally (21年1月22日) 配合飼料高騰 長期化に農家恐々 負担増へ先手置き換え急ぐ 食べ残し削減徹底 日本農業新聞 21.1.22 (20 |